UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

BIOFRONTERA INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

120 Presidential Way, Suite 330

Woburn, Massachusetts 01801

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on Monday, May 22, 2023April 24, 2024

Dear Stockholder of Biofrontera Inc.:

NOTICE IS HEREBY GIVEN that a special meeting of the stockholders (the “Special Meeting”) of Biofrontera Inc., a Delaware corporation (the “Company”), will be held on Monday, May 22, 2023,April 24, 2024, at 9:10:00 a.m.,AM, Eastern Time and will be a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. There will not be a physical location for the Special Meeting.

You will be able to attend the Special Meeting virtually and to vote and submit questions prior to and during the virtual Special Meeting by registering at https://web.viewproxy.com/bfri/2023 by May 21, 2023 at 11:59 pm Eastern Time. You will receive a unique linkvisiting meetnow.global/M4ZZN6D and passwordentering the 16-digit control number provided in order to attend the meeting.these proxy materials.

We are holding the Special Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

| (1) | to approve an amendment to our Amended and Restated Certificate of Incorporation, to | |

| (2) | to approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the |

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. The Board of Directors has fixed the close of business on April 20, 2023March 18, 2024 as the record date (the “Record Date”) for determining those stockholders who are entitled to notice of and to vote at the Special Meeting or any adjournment or postponement of the Special Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary, or you may also virtually attend the Special Meeting and vote online during the Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MONDAY, MAY 22, 2023 AT 9:00 A.M. EASTERN TIME:APRIL 24, 2024: THE COMPANY’S PROXY MATERIALS AND ANNUAL REPORT ARE AVAILABLE AT https:http://web.viewproxy.com/bfri/2023.www.edocumentview.com/BFRI.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, PLEASE SUBMIT A PROXY TO HAVE YOUR SHARES VOTED AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR THE DESIGNATED TOLL-FREE TELEPHONE NUMBER, OR BY SIGNING, DATING AND RETURNING BY MAIL THE PROXY CARD ENCLOSED WITH THE PROXY STATEMENT. IF YOU DO NOT RECEIVE THE PROXY MATERIALS IN PRINTED FORM AND WOULD LIKE TO SUBMIT A PROXY BY MAIL, YOU MAY REQUEST A PRINTED COPY OF THE PROXY MATERIALS (INCLUDING THE PROXY) AND SUCH MATERIALS WILL BE SENT TO YOU.

On behalf of the Board of Directors and the employees of Biofrontera Inc. we thank you for your continued support.

|   | |

| Prof. Hermann | ||

| Chief Executive Officer; Chairman | Chief |

April 21, 2023March 20, 2024

120 Presidential Way, Suite 330

Woburn, Massachusetts 01801

PROXY STATEMENT

For the Special Meeting of Stockholders to be held on Monday, May 22, 2023April 24, 2024

The Company is providing this Proxy Statement in connection with the solicitation by its Board of Directors (the “Board”“Board of Directors”) of proxies to be voted at the Special Meeting to be held on Monday, May 22, 2023,April 24, 2024, at 9:10:00 a.m.,AM, Eastern Time, solely over the Internet in a virtual-only format, and any adjournment or postponement thereof.

Only stockholders as of April 20, 2023March 18, 2024 (the “Record Date”) may attend the Special Meeting. At the close of business on the Record Date, we had 26,699,0025,089,413 shares of Common Stockour common stock, par value $0.001 per share (our “Common Stock”) outstanding, and entitled to vote.cast one vote per share, and 4,806 shares of our Series B-1 Convertible Preferred Stock (the “Preferred Stock”) outstanding, representing 28,191 votes entitled to be cast at the Special Meeting. We made our proxy materials available to stockholders via the Internet or in printed form on or about April 21, 2023.March 27, 2024. Our proxy materials include the Notice of the Special Meeting, this Proxy Statement and the proxy card. These proxy materials, other than the proxy card, which is available with the printed materials, can be accessed at https:http://web.viewproxy.com/bfri/2023.www.edocumentview.com/BFRI.

You are invited to attend the Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy. The matters to be acted on are stated in the accompanying Notice of Special Meeting of Stockholders. The proxy materials, including this Proxy Statement, are being distributed and made available on or about April 21, 2023.

If you have any questions regarding the accompanying proxy statement or how to vote your shares, you may contact Alliance Advisors, LLC, our proxy solicitor, at 844-717-2301 or email: BFRI@allianceadvisors.com.March 27, 2024.

TABLE OF CONTENTS

Appendix A – Form of ReverseIncrease to Authorized Common Stock Split Amendment

| Q: | Why am I receiving these materials? |

| A: | We have sent you these proxy materials because the Board of Directors is soliciting your proxy to vote at the Special Meeting, including at any adjournments or postponements of the Special Meeting. |

| Q: | What proposals are being presented for a stockholder vote at the Special Meeting? |

| A: | The following proposals are being presented for stockholder vote at the Special Meeting: |

| ● | Proposal No. 1- approval of an amendment to our Amended and Restated Certificate of Incorporation, to | |

| ● | Proposal No. 2 |

| Q: | How does the Board of Directors recommend that I vote? |

| A: | The Board of Directors unanimously recommends that you vote “FOR” Proposals No. 1 and No. 2. |

| |

| Q: | What does it mean to vote by proxy? |

| A: | When you vote “by proxy,” you grant another person the power to vote stock that you own. If you vote by proxy in accordance with this proxy statement, you will have designated the following individuals as your proxy holders for the Special Meeting: Hermann |

| Any proxy given pursuant to this solicitation and received in time for the Special Meeting will be voted in accordance with your specific instructions. If you provide a proxy, but you do not provide specific instructions on how to vote on each proposal, the proxy holder will vote your shares “FOR” Proposals No. 1 and Proposal No. 2. With respect to any other business that properly comes before the Special Meeting, the proxy holders will vote in their own discretion according to their best judgment, to the extent permitted by applicable laws and regulations. |

| Q: | Who can vote at the Special Meeting? | |

| A: | Only stockholders of record at the close of business on the Record Date, will be entitled to vote at the Special Meeting. On the Record Date, there were | |

| Stockholder of Record: Shares Registered in Your Name | ||

| If on the Record Date, your shares were registered directly in your name with the Company’s transfer agent, Computershare Trust Company, then you are a stockholder of record. As a stockholder of record, you may directly vote your shares or submit a proxy to have your shares voted. We urge you to fill out and return the enclosed proxy card or submit a proxy on the internet or telephone as instructed below to ensure your vote is counted. |

| 1 |

| Beneficial Owner: Shares Registered in the Name of a Broker or Bank | ||

| If on the Record Date, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You will receive voting instructions from your broker, bank or nominee describing the available processes for voting your stock. |

| Q: | What shares can I vote? |

| A: | You may vote or cause to be voted all shares of Common Stock and the Preferred Stock owned by you as of the close of business on the Record Date. These shares include: (1) shares held directly in your name as a stockholder of record; and (2) shares held for you, as the beneficial owner, through a broker or other nominee, such as a bank. Holders of our Common Stock and the Preferred Stock will vote together on all matters presented at the Special Meeting. |

| Q: | How many votes am I entitled to? |

Common Stock Each share of Common Stock is entitled to one vote on the matters presented at the Special Meeting. The Preferred Stock Pursuant to the Certificate of Designation that created the Preferred Stock, if you hold any of the Preferred Stock that is issued and outstanding as of the close of business on the Record Date you are entitled to vote your shares of Preferred Stock on an as-converted basis up to the beneficial ownership limitation elected by such holder. Currently all holders of the Preferred Stock have elected a 9.99% beneficial ownership limitation and consequently you will be entitled to cast an additional number votes for your Preferred Stock based on the number of shares of Common Stock you could convert your Preferred Stock into without exceeding 9.99% of our outstanding Common Stock (on an as-converted basis). The exact number of additional votes on the matters presented at the Special Meeting will vary from holder to holder and will be indicated on the enclosed proxy card. | |

| Q: | How may I vote? |

| A: | The procedures for voting are fairly simple: |

| Stockholder of Record: Shares Registered in Your Name | |

| If you are a stockholder of record, you may have your shares voted by proxy using the enclosed proxy card, or submit your proxy through the internet or by telephone. We urge you to have your shares voted by proxy to ensure your vote is counted. |

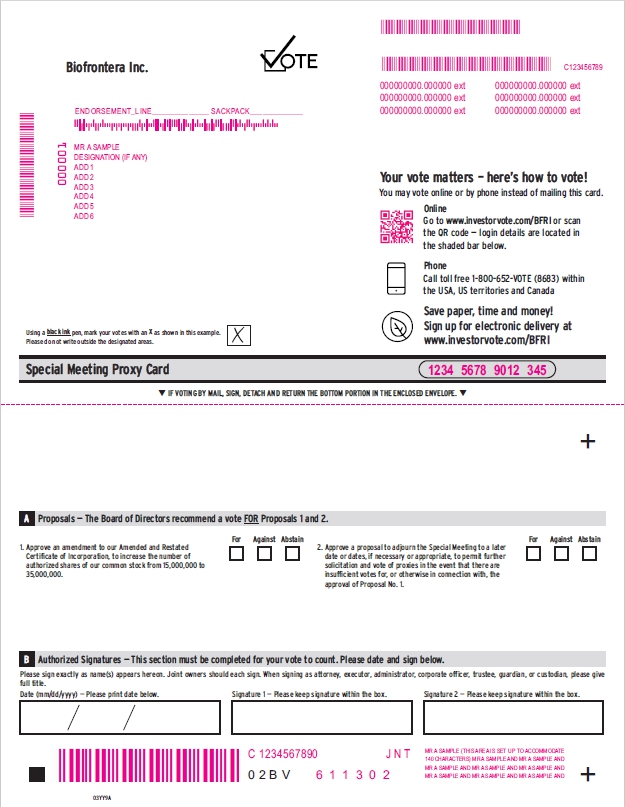

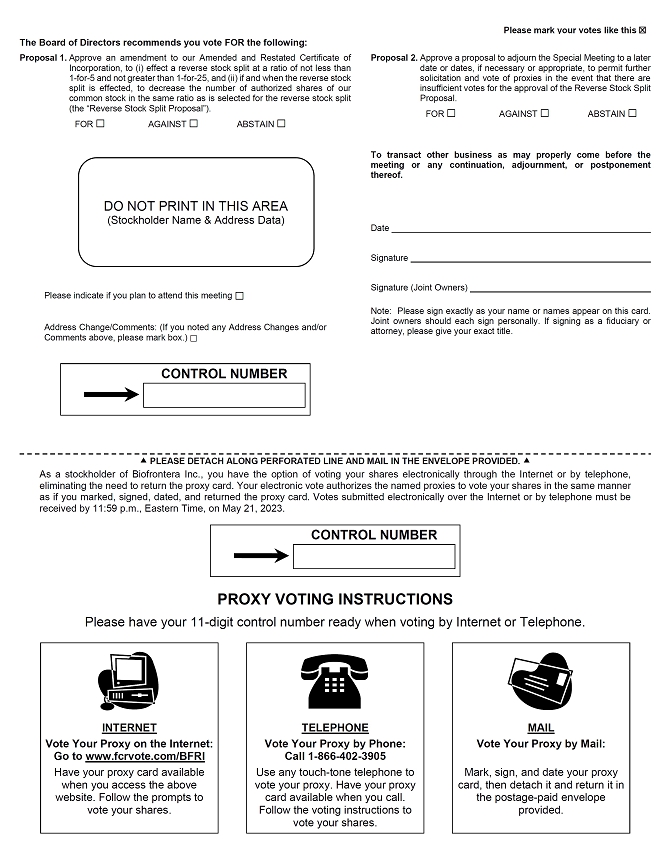

| ● | By mail. To have your shares voted using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, the proxyholder will vote your shares as you direct. |

| 2 |

| ● | By internet or telephone. To have your shares voted through a proxy submitted by the internet, go to | |

| ● | By voting at the Special Meeting. You may vote your shares during the virtual-only Special Meeting. See the instructions in the Notice of the Special Meeting to attend the meeting virtually and vote your shares. |

If you are a holder of the Preferred Stock and you vote by any of the means listed above, all of the votes you are entitled to based on your holdings of Common Stock and Preferred Stock as of the Record Date will be voted in the manner you instructed. Beneficial Owner: Shares Registered in the Name of Broker or Bank | |

| If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from the Company. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form. | |

| Q: | What happens if I do not vote? |

| Stockholder of Record: Shares Registered in Your Name | |

| If you are a stockholder of record and do not vote in person or proxy by completing your proxy card or submitting your proxy through the internet or by telephone, your shares will not be voted. | |

| Beneficial Owner: Shares Registered in the Name of Broker or Bank | |

| If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether Nasdaq deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of Nasdaq, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. |

| 3 |

| Q: | What if I return a proxy card or otherwise submit a proxy but do not make specific choices? |

| A: | If you are a record holder and return a signed and dated proxy card or otherwise submit a proxy without marking voting selections, your shares will be voted, as applicable, “FOR” Proposals No. 1 and No. 2. If any other matter is properly presented at the Special Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares (including any votes represented by the Preferred Stock) in accordance with the |

| Q: | Can I change my vote or revoke my proxy? |

| A: | You may change your vote or revoke your proxy at any time before the final vote at the Special Meeting. To change how your shares are voted or to revoke your proxy if you are the record holder, you may (1) notify our Corporate Secretary in writing at Biofrontera Inc., 120 Presidential Way, Suite 330, Woburn, Massachusetts 01801; (2) submit a later-dated proxy (either by mail or internet), subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable; or (3) deliver to |

For shares you hold beneficially, you may change your vote by following the instructions provided by your broker or bank. If you are a holder of Preferred Stock and you change your vote or revoke your proxy at any time before the final vote at the Special Meeting, your actions will apply to all of the votes you are entitled to cast. | |

| Q: | Who can help answer my questions? |

| A: | If you have any questions about the Special Meeting or how to vote, submit a proxy or revoke your proxy, or you need additional copies of this Proxy Statement or voting materials, you should contact |

Q: | What is a quorum and why is it necessary? |

| A: | Conducting business at the Special Meeting requires a quorum. A quorum will be present if stockholders holding at least one-third of the |

| Q: | What is a “broker non-vote”? |

| A broker “non-vote” occurs when a broker, bank or other intermediary that is otherwise counted as present or represented by proxy does not receive voting instructions from the beneficial owner and does not have the discretion to vote the shares. A broker “non-vote” will be counted for purposes of calculating whether a quorum is present at the Special Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect to a particular proposal as to which that broker “non-vote” occurs. Thus, a broker “non-vote” will not impact our ability to obtain a quorum for the Special Meeting and will not otherwise affect the approval by a majority of the votes present in person or represented by proxy and entitled to vote of any of the Proposals. | |

| 4 |

Q | What are the voting requirements for each Proposal? |

| A: | Proposal No. 1: The affirmative vote of a majority of the voting power of the shares of the Company that are outstanding and entitled to vote on the matter at the Special Meeting is required to approve the |

| Proposal No. 2: The affirmative vote of a majority of the | |

| Q: | What should I do if I receive more than one Proxy Statement? |

| A: | You may receive more than one Proxy Statement. For example, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Proxy Statement. Please follow the voting instructions on all of the Proxy Statements to ensure that all of your shares are voted. |

| Q: | Where can I find the voting results of the Special Meeting? |

| A: | We intend to announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K, which will be filed within four (4) business days of the Special Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the Special Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results. |

| Q: | What happens if the Special Meeting is adjourned? |

| A: | The Company is required to notify stockholders of any adjournments of more than 30 days or if a new record date is fixed for the adjourned meeting. Except as described above, notice is not required for an adjourned meeting if the time, place and means of remote communication for the adjourned meeting are announced at the meeting at which the adjournment occurs. Unless a new record date is fixed, your proxy will still be valid and may be voted at the adjourned meeting unless properly revoked. You will still be able to change or revoke your proxy until it is voted. |

| Q: | How many shares are outstanding and how many votes is each share entitled? |

| A: | Each share of our Common Stock that is issued and outstanding as of the close of business on the Record Date, is entitled to be voted on all items being voted on at the Special Meeting, with each share being entitled to one vote on each matter. As of the Record Date, As of the Record Date there are 4,806 shares of Preferred Stock issued and outstanding, with the holders of the Preferred Stock entitled to cast an aggregate of 28,191 votes (not including the votes they may cast for any Common Stock that they hold). The total number of votes that are entitled to be cast by the holders of our Common Stock and the Preferred Stock at the Special Meeting are 5,117,604. |

| Q: | Who will count the votes? |

| A: | |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within the Company or to anyone else, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a successful proxy solicitation. |

| 5 |

| Q: | Who will bear the cost of soliciting votes for the Special Meeting? |

| A: | The Board of Directors is making this solicitation on behalf of the Company, which will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. |

Q: A: | How can I attend the Special Meeting with the ability to ask a question and/or vote? The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Special Meeting only if you were a stockholder of the Company as of the close of business on the Record Date (“Registered Holder”), or if you hold a valid legal proxy for the Special Meeting if you are a beneficial holder and hold your shares through an intermediary, such as a bank or broker (“Beneficial Holder”). No physical meeting will be held.

As a Registered Holder, you will be able to attend the Special Meeting online, ask a question and vote by

If you are a Beneficial Holder and want to attend the Special Meeting online by webcast (with the ability to ask a question and/or vote, if you choose to do so) you have two options:

(1) Registration in Advance of the Special Meeting Submit proof of your proxy power (“Legal Proxy”) from your broker or bank reflecting your Biofrontera Inc. holdings along with your name and email address to

Requests for registration as set forth in above must be labeled as “Legal Proxy” and be received no later than

Requests for registration should be directed to us at the following: By email: Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to legalproxy@computershare.com By mail: Computershare Biofrontera Inc. Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 (2) Registration at the Special Meeting Please go to

The online meeting will begin promptly at

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call |

| 6 |

PROPOSAL NO. 1-APPROVAL OF REVERSE STOCK SPLITSHARE INCREASE PROPOSAL

Our Amended and Restated Certificate of Incorporation, as amended (our “Certificate of Incorporation”), currently authorizes the issuance of 15,000,000 shares of Common Stock, par value $0.001 pe share. On March 7, 2024, our Board adopted a resolution to amend the Certificate of Incorporation, subject to stockholder approval by increasing the number of authorized shares of our Common Stock to 35,000,000 shares (the “Share Increase Amendment”). The additional 20,000,000 shares of Common Stock authorized for issuance pursuant to the proposed Share Increase Amendment would be part of the existing class of Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock presently issued and outstanding. The holders of Common Stock are not entitled to preemptive rights or cumulative voting. The Share Increase Amendment will not affect the number of authorized shares of preferred stock of the Company, par value $0.001 per share, which is 20,000,000 shares. Currently, there are 4,806 shares of Series B-1 Convertible Preferred Stock issued and outstanding.

The Board is asking stockholders to approve the Reverse Stock SplitShare Increase Proposal. The form of the Certificate of Amendment to the Certificate of Incorporation to be filed with the Secretary of State of the State of Delaware to effect the Share Increase Amendment is set forth as Appendix A to this proxy statement (the “Amendment”“Certificate of Amendment”). Although such filing is within the control of the Board, weWe expect such filing to be made shortlyas soon as practicable after the approval by the stockholders of the Stock SplitShare Increase Proposal. The Share Increase Amendment will become effective at such future date as determined by the Board, upon the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware (which we referDelaware. No other changes to asour Certificate of Incorporation are being proposed, including with respect to the “Effective Time”), but in no event earlier than the datenumber of the Special Meeting. Moreover, even if theauthorized shares of our preferred stock. The Share Increase Amendment is approved bynot intended to modify the requisite numberrights of existing stockholders the Board reserves the right, at its discretion, to abandon the Amendment prior to the proposed effective date if it determines that abandoning the Amendment is in our best interests. No further action on the part of stockholders would be required to either effect or abandon the Amendment.any material respect.

The text of the Certificate of Amendment is subject to modification to include such changes as may be required by DGCL and as the Board deems necessary and advisable to effect the Share Increase Amendment.

A brief description of the Stock SplitShare Increase Proposal is set out below.

Purpose ofReasons for the Reverse Stock SplitShare Increase Amendment

The Board seeks your approval for the Reverse Stock Split as part of the Amendment with the intent of increasing the per share trading price of our Common Stock, which is publicly traded and listed on the Nasdaq Capital Market under the symbol, “BFRI,” in order to regain compliance with the minimum bid price requirement as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Requirement”), for continued listing on the Nasdaq. Accordingly, we believe that effecting the Reverse Stock Split would be in our and our stockholders’ best interests.Private Placement Obligations

On February 24, 2023,19, 2024, we entered into a securities purchase agreement (the “Purchase Agreement”) with several healthcare-focused investors pursuant to which we issued (i) 6,586 shares of Preferred Stock, par value $0.001 per share and (ii) warrants (the “Warrants”) to purchase up to 8,000 shares of Series B-3 Convertible Preferred Stock, par value $0.001 per share (the “Private Placement”). On February 22, 2024, concurrent with the closing of the Private Placement, the purchasers delivered notices of initial conversion requesting that the Company received a notice letter (the “Notice”) fromconvert some of their Preferred Stock into Common Stock, resulting in the Listing Qualifications Departmentissuance of 2,516,785 shares of Common Stock. The NasdaqCompany has reserved sufficient shares of Common Stock Market LLC (“Nasdaq”) notifyingto cover the Company that, basednumber of shares issuable upon the closing bid priceconversion of the Commonremaining shares of Preferred Stock, for the last 30 consecutive business days, the Company is not currently in compliance with the requirement to maintain the Minimum Bid Requirement.

To regain compliance, the closing bid price of the Common Stock must be at least $1.00 per share for ten consecutive business days at some point during the period of 180 calendar days from the date of the Notice, or until August 23, 2023. Ifbut the Company does not regain compliance with the minimum bid price requirement by August 23, 2023, Nasdaq may grant the Company a second period of 180 calendar days to regain compliance. To qualify for this additional compliance period, the Company would be required to meet the continued listing requirement for the market value of publicly heldcurrently have enough authorized shares and all other initial listing standards for Nasdaq, other than the minimum bid price requirement. In addition, the Company would also be required to notify Nasdaq of its intent to cure the minimum bid price deficiency. If the Company does not regain compliance within the allotted compliance periods, including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that the Common Stock will be subject to delisting. The Company would then be entitled to appeal that determination to a Nasdaq hearings panel.

In addition, the Company believes that the Reverse Stock Split will make the Common Stock a more attractive and cost-effective investment for many investors, which in turn may enhance the liquidity of the holders of the Common Stock, as it believes that the current market price of the Common Stock may prevent certain institutional investors, professional investors, and other members of the investing public from purchasing stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Many institutional investors view stocks trading at low prices as unduly speculative in nature and, as a result, avoid investing in such stocks. The Reverse Stock Split could also increase interest in our Common Stock for analysts and brokers who may otherwise have policies that discourage or prohibit them in following or recommending companies with low stock prices. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of Common Stock can result in individual stockholders paying transaction costs representing a higher percentageto cover the shares of Common Stock that would be issuable upon conversion of the Series B-3 Convertible Preferred Stock if the investors exercised all of their total share value thanWarrants.

The Purchase Agreement includes a covenant that within 30 days of the closing of the Private Placement, we would befile a preliminary proxy statement containing the case ifShare Increase Proposal for approval of our stockholders and file this proxy statement as soon as practicable thereafter. If the share price were higher.stockholders do not approve the Share Increase Proposal at this Special Meeting, the Company has agreed to submit the Share Increase Proposal for stockholder approval on at least a semi-annual basis until such stockholder approval is obtained and we will incur the costs associated therewith.

| 7 |

Risks of Non-Approval

Failure to approveOnce the Reverse Stock Splitstockholders have approved the Share Increase Proposal, may potentially have serious, adverse effects on the Company will be obligated under the Purchase Agreement to file the Certificate of Amendment as soon as practicable to effect the Share Increase Amendment and, its stockholders. The Common Stock could be delisted fromonce the Nasdaq because shares of the Common Stock may continueShare Increase Amendment is effective, to trade below the requisite $1.00 per share price needed to maintain our listing in accordance with Nasdaq Listing Rule 5550(a)(2). Our shares may then trade on the OTC Bulletin Board or other small trading markets, such as the pink sheets. In that event, the Common Stock could trade thinly as a microcap or penny stock, adversely decrease to nominal levels of trading, and may be avoided by retail and institutional investors, resulting in the impaired liquidity of the Common Stock.

As of the Record Date, the Common Stock closed at $0.60 per share on Nasdaq. Reducing the number of outstandingreserve sufficient shares of Common Stock should, absent other factors, generally increaseto cover the conversion of the Series B-3 Convertible Preferred Stock that could be issued upon exercise of the Warrants. Based on the current conversion price of $0.7074 per share, market pricean additional 11,309,019 shares of Common Stock would need to be reserved. If we are unable to reserve sufficient shares to cover the conversion of the common stock. AlthoughSeries B-3 Convertible Preferred Stock, then we do not expect the intentinvestors will exercise any of their Warrants and we would not receive up to $8 million in aggregate gross proceeds from the exercise of the ReverseWarrants. The issuance of shares of Common Stock Splitthat have been reserved for securities issued in connection with the Private Placement would still be subject to conversion limitations in the Certificate of Designation for the Series B Convertible Preferred Stock which currently prevent any holder from converting any such preferred stock if it would cause such holder to beneficially own more than 9.99% of our outstanding Common Stock following the conversion. Any such issuance would also be subject to the rules of the Nasdaq Capital Market, including the requirement to obtain separate stockholder approval if the number of shares that could be issued to a stockholder would be deemed a change of control.

For more information regarding the Private Placement, including the conversion limitations on the Series B Convertible Preferred Stock, please see our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 23, 2024.

Future Needs of Our Business

Our Board believes it is in the best interests of the Company and our stockholders to increase our authorized shares of Common Stock in order to have additional shares available for use as our Board deems appropriate or necessary. As such, one of the purposes of the Share Increase Amendment is to provide the Company with greater flexibility with respect to managing its Common Stock in connection with such corporate purposes as may, from time to time, be considered advisable by our Board. These corporate purposes could include, without limitation, financing activities, public or private offerings of Common Stock, stock dividends or splits, conversions of convertible securities, issuance of options and other equity awards pursuant to our incentive plans, establishing a strategic relationship with a corporate collaborator and acquisition transactions. Having an increased number of authorized but unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase in our capitalization. Our Board will determine whether, when and on what terms the priceissuance of shares of Common Stock may be warranted in connection with any of the foregoing purposes.

If the Share Increase Proposal is not approved, we will not be able to raise future capital without first obtaining stockholder approval for an increase in the number of authorized shares of Common Stock. The cost, prior notice requirements and delay involved in obtaining stockholder approval at the time that corporate action may be necessary or desirable could completely eliminate our ability to opportunistically capitalize on favorable market windows, which could delay or preclude our ability to advance our product candidate development and potential commercialization efforts. In addition, our success depends in part on our continued ability to attract, retain and motivate highly qualified management and clinical personnel, and if the Share Increase Proposal is not approved by our stockholders, the lack of unissued and unreserved authorized shares of Common Stock there can be no assuranceto provide future equity incentive opportunities that even if the Reverse Stock Split is effected the bid priceCompensation Committee of the Board deems appropriate could adversely impact our ability to achieve these goals.

The Board believes that the proposed increase in authorized Common Stock will bemake sufficient over time, forshares available to fulfill the CompanyCompany’s obligations in the Private Placement and to regain or maintain compliance withprovide the Minimum Bid Requirement.

Principal Effectsadditional flexibility necessary to pursue our strategic objectives. As of the Reverse Stock Split

Depending ondate of this proxy statement, other than the ratio forPrivate Placement, we have no current plans, arrangements or understandings regarding the Reverse Stock Split determined by the Board, a minimumissuance of five and a maximum of twenty-five shares of existing common stock will be combined into one new share of common stock. Based on 26,699,002any additional shares of common stock issuedthat would be authorized pursuant to this proposal, and outstanding as of April 21, 2023, immediately following the Reverse Stock Split, the Company would have approximately 5,339,801 shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) if the ratio for the Reverse Stock Split is one-for-five (1:5), and approximately 1,067,960 shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) if the ratio for the Reverse Stock Split is one-for-twenty-five (1:25). Any other ratio selected within such range would result in a number of shares of common stock issued and outstanding (without giving effect to rounding for fractional shares) following the transaction between approximately 1,067,960 and 1,779,933 shares. Fractional shares will not be issued. Instead, we will issue a full share of post-Reverse Stock Split common stock to any stockholder who would have been entitled to receive a fractional share of common stock as a result of the Reverse Stock Split.

The actual number of shares issued after giving effectthere are no negotiations pending with respect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio that is ultimately determined by the Board.

The Reverse Stock Split will affect all holders of our common stock uniformly and will not affectissuance thereof for any stockholder’s percentage ownership interest in us, except to the extent the Reverse Stock Split would result in fractional shares, as described above. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power, except to the extent the Reverse Stock Split would result in fractional shares, as described above.

The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

After the Reverse Stock Split is effective, our common stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers, which are numbers used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act of 1934, as amended. Assuming that the Company’s meets the Minimum Bid Price Requirement, we expect that our common stock will continue to be quoted on The Nasdaq Capital Market under the symbol “BFRI.”purpose.

| 8 |

Beneficial Holders of Common Stock (i.e., stockholders who hold in street name)

Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our common stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our common stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered “Book-Entry” Holders of Common Stock (i.e., stockholders that are registered on the transfer agent’s books and records but do not hold stock certificates)

Certain of our registered holders of common stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownershipPrincipal Effects of the common stock. They are, however, provided with a statement reflectingShare Increase Amendment

The following table illustrates the effect the proposed Share Increase Amendment would have on the number of shares registered in their accounts.of Common stock available for issuance, if approved by our stockholders:

| As of March 18, 2024 | Upon Effectiveness of the Share Increase Amendment | |||||||

| TOTAL AUTHORIZED SHARES OF COMMON STOCK | 15,000,000 | 35,000,000 | ||||||

| Outstanding shares of Common Stock | 5,089,413 | 5,089,413 | ||||||

| Shares of Common Stock authorized for future issuance under the Company’s incentive plan | 151,900 | 151,900 | ||||||

| Shares of Common Stock subject to outstanding equity awards under the Company’s incentive plans | 94,181 | 94,181 | ||||||

| Shares of Common Stock issuable upon exercise of outstanding warrants (excluding the Warrants) | 2,269,356 | 2,269,356 | ||||||

| Shares of Common Stock issuable upon conversion of preferred stock (including preferred stock issuable upon exercise of the Warrants) | 6,793,893 | 18,102,912 | (1) | |||||

| Shares of Common Stock issuable upon exercise of outstanding Unit Purchase Options (2) | 20,182 | 20,182 | ||||||

| Total outstanding shares of Common Stock and shares of Common Stock Reserved | 14,418,925 | 25,727,944 | ||||||

| Unreserved shares of Common Stock available for issuance (1) | 581,075 | 9,272,056 | ||||||

Stockholders who hold shares electronically in book-entry form with

(1) Pursuant to the transfer agent will not need to take action (the exchange will be automatic) to receivePurchase Agreement, upon effectiveness of the Share Increase Amendment, we would reserve 11,309,019 shares of post-ReverseCommon Stock Split common stock.

Effect of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards and Units and Warrants

Based upon the reverse stock split ratio determined by the Board, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in approximately the same aggregate price being required toSeries B-3 Convertible Preferred Stock that may be paid under such options, warrants, convertible or exchangeable securitiesacquired upon exercise of the Warrants.

(2) Issued in conjunction with the Company’s initial public offering and approximately the same value ofa private placement in December 2021.

Other than shares of common stock being delivered upon such exercise, exchange or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares deliverable upon settlement or vesting of restricted stock awardsthat will be similarly adjusted. The number of shares reserved for issuance pursuant to these securities will be proportionately basedunder our existing incentive plan, outstanding warrants, and upon the reverseconversion of preferred stock split ratio determined by the Board.

Certain Risks and Potential Disadvantages Associated with a Reverse Stock Split

We cannot assure stockholders that the proposed Reverse Stock Split will sufficiently increase our stock pricehas been or be completed before Nasdaq commences delisting procedures. The effect of a Reverse Stock Split on our stock price cannot be predicted with any certainty, and the history of reverse stock splits for other companies, including those in our industry, is varied, particularly since some investors may view a reverse stock split negatively. It is possible that our stock price after a Reverse Stock Split will not increase in the same proportion as the reduction in the number of shares outstanding, causing a reduction in the Company’s overall market capitalization. Further, even if we implement the Reverse Stock Split, our stock price may decline due to various factors, including our future performance and general industry, market and economic conditions. This percentage decline, as an absolute number and as a percentage of our overall market capitalization, may be greater than would occur in the absence of the Reverse Stock Split. If we continue to fail to meet Nasdaq’s listing requirements, Nasdaq may suspend trading and commence delisting proceedings.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by the reduced number of shares outstanding after the Reverse Stock Split, which would be exacerbated if the stock price does not increase following the Reverse Stock Split. In addition, a Reverse Stock Split would increase the number of stockholders owning “odd lots” of fewer than 100 shares, trading in which generally results in higher transaction costs. Accordingly, a Reverse Stock Split may not achieve the desired results of increasing marketability and liquidity as described above.

Stockholders should also keep in mind that the implementation of a Reverse Stock Split does not have an effect on the actual or intrinsic value of our business or a stockholder’s proportional ownership interest (subject to the treatment of fractional shares). However, should the overall value of our common stock decline after a Reverse Stock Split, then the actual or intrinsic value of shares held by stockholders will also proportionately decrease as a result of the overall decline in value.

Fractional Shares

No fractional shares will be issued in connection with Private Placement, we do not currently have any arrangements, agreements or understandings that would require the Reverse Stock Split. Instead, we will issue one full shareissuance of post-reverse stock split common stock to any stockholder who would have been entitled to receive a fractional share as a result of the process. Each common stockholder will hold the same percentage of the outstanding common stock immediately following the Reverse Stock Split as that stockholder did immediately prior to the Reverse Stock Split, except for minor adjustment due to the additional net share fraction that will need to be issued as a result of the treatment of fractional shares.

Authorized Sharesshares of Common Stock

We are currently authorized under our Amended and Restated Certificate of Incorporation, to issue up to a total of 320,000,000 shares of capital stock, comprised of 300,000,000 shares of common stock and 20,000,000 shares of preferred stock. Authorized shares represent the number of shares of common stock that we are permitted to issue under our Amended and Restated Certificate of Incorporation. If the Reverse Stock Split Proposal is implemented, the Amendment would also reduce both the number of issued and outstanding shares of common stock and the number of authorized shares of common stock in the same ratio as is selected for the Reverse Stock Split.

As a result, immediately following the Reverse Stock Split, the number of authorized shares of common stock will be 60,000,000 if the ratio for the Reverse Stock Split selected is one-for-five (1:5), and the number of authorized shares of common stock will be 12,000,000 if the ratio for the Reverse Stock Split is one-for-twenty-five (1:25). Any other ratio selected within such range would result in the number of authorized shares of common stock following the transaction to be between 12,000,000 and 60,000,000 shares.

As a result of the decrease in authorized shares of common stock that will occur if and when the Reverse Stock Split is effected, the same proportion of authorized but unissued shares of common stock to shares of common stock authorized and issued (or reserved for issuance, including any treasury shares) would be maintained as of the Effective Time (except for any changes as a result of the treatment of fractional shares).

If the Reverse Stock Split is abandoned or deemed to be abandoned by our Board, the decrease in the number of authorized shares will also be abandoned or deemed to be abandoned by our Board.

Appraisal Rights

Under the Delaware General Corporation Law, our stockholders are not entitled to appraisal or dissenter’s rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Accounting MattersStock.

The Reverse Stock SplitShare Increase Amendment will not, affectby itself, have an immediate dilutive effect on our existing stockholders. However, our Board will have the parauthority to issue authorized Common Stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or rules of the Nasdaq Stock Market. Future issuances of Common Stock or securities convertible into or exchangeable for Common Stock could have a dilutive effect on our earnings per share, book value per share and the voting power and interest of current stockholders.

Our Board has not proposed the Share Increase Amendment with the intention of discouraging tender offers or takeover attempts of the Company. However, the availability of additional authorized shares for issuance could, under certain circumstances, discourage or make more difficult efforts to obtain control of our common stock. As a result, oncompany. This proposal is not being presented with the effective date of the reverse stock split, the stated capital account on our balance sheet attributableintent that it be used to the common stock will be reduced by at least up to 96% of its present amount, as the case may be, based on the ratio for the reverse stock split as determined byprevent or discourage any acquisition attempt, but nothing would prevent our Board from taking any appropriate actions not inconsistent with the additional paid-in capital account being credited with the amount by which the stated capital account is reduced. The per share net loss and net book value of our common stock will be retroactively adjusted for each period because there will be fewer shares of our common stock outstanding for all periods presented.

U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain material U.S. federal income tax consequences of the Reverse Stock Split to the holders of our common stock. It addresses only stockholders who hold our common stock as capital assets. It does not purport to be complete, does not address all aspects of U.S. federal income taxation that may be relevant to holders in light of their particular circumstances, does not address U.S. federal estate or gift taxes, the alternative minimum tax or the Medicare tax on investment income, and does not address stockholders subject to special rules, including without limitation financial institutions, tax-exempt organizations, insurance companies, dealers in securities, foreign stockholders, stockholders who hold their pre-Reverse Stock Split shares as part of a straddle, hedge or conversion transaction, and stockholders who acquired their pre-Reverse Stock Split shares pursuant to the exercise of employee stock options or otherwise as compensation. In addition, this summary does not consider or discuss the tax treatment of partnerships or other pass-through entities or persons that hold our shares through such entities.

This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), regulations, rulings, and decisions in effect on the date hereof, all of which are subject to change (possibly with retroactive effect) and to differing interpretations. It does not address tax considerations under state, local, foreign and other laws. This summary is for general information purposes only, and the tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the Reverse Stock Split.

The Reverse Stock Split is intended to constitute a “recapitalization” within the meaning of Section 368(a)(1)(E) of the Code for U.S. federal income tax purposes. Assuming that such treatment is correct, the Reverse Stock Split generally will not result in the recognition of gain or loss for U.S. federal income tax purposes, except potentially with respect to any additional fractions of a share of our common stock received as a result of the rounding up of any fractional shares that otherwise would be issued, as discussed below. Subject to the following discussion regarding a stockholder’s receipt of a whole share of our common stock in lieu of a fractional share, the adjusted basis of the new shares of common stock will be the same as the adjusted basis of the common stock exchanged for such new shares. The holding period of the new, post-Reverse Stock Split shares of the common stock resulting from implementation of the Reverse Stock Split will include the stockholder’s respective holding periods for the pre-Reverse Stock Split shares. Stockholders who acquired their shares of our common stock on different dates or at different prices should consult their tax advisors regarding the allocation of the tax basis of such shares.

As described above in “Fractional Shares”, no fractional shares of our common stock will be issued as a result of the Reverse Stock Split. Instead, we will issue one (1) full share of the post-Reverse Stock Split common stock to any stockholder who would have been entitled to receive a fractional share as a result of the process. The U.S. federal income tax consequences of the receipt of such additional fraction of a share of our common stock are not clear. A stockholder who receives one (1) whole share of our common stock in lieu of a fractional share may recognize income or gain in an amount not to exceed the excess of the fair market value of such share over the fair market value of the fractional share to which such stockholder was otherwise entitled. We are not making any representation as to whether the receipt of one (1) whole share in lieu of a fractional share will result in income or gain to any stockholder, and stockholders are urged to consult their own tax advisors as to the possible tax consequences of receiving a whole share in lieu of a fractional share in the Reverse Stock Split.

We have not sought, and will not seek, any ruling from the Internal Revenue Service or an opinion of tax counsel with respect to the matters discussed herein. The foregoing views are not binding on the Internal Revenue Service or the courts, and there can be no assurance that the Internal Revenue Service or the courts will accept the positions expressed above. The state and local tax consequences of a reverse stock split may vary significantly as to each holder of our common stock, depending upon the state in which such holder resides or does business. Accordingly, each stockholder should consult with their own tax advisor with respect to all of the potential tax consequences to him or her of the Reverse Stock Split.its fiduciary duties.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly,outstanding equity awards under our incentive plans, and may be granted additional equity awards under these plans, and therefore may be deemed to have an indirect interest in the matters set forth in this proposal exceptShare Increase Amendment because, absent the amendment, the Company may not have sufficient authorized shares to the extent of their ownership of shares of our Common Stock.make future awards.

Reservation of Right to Abandon Reverse Stock SplitAppraisal Rights

We reserveUnder the rightDelaware General Corporation Law, our stockholders are not entitled to not fileappraisal rights with respect to the Certificate ofShare Increase Amendment, and to abandon any Reverse Stock Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the Certificate of Amendment, even if the authority to effect the amendment is approved by our stockholders at the Special Meeting. By voting in favor of the Reverse Stock Split, you are expressly also authorizing the Board to delay, not proceed with, and abandon, the Reverse Stock Split and the Certificate of Amendment if the Board should so decide, in its sole discretion, that such actions are in the best interests of our stockholders.

Consequences if the Reverse Stock Split is Not Approved

In the event that the Reverse Stock Split is not approved, there is a significant likelihood that we will be delisted from the Nasdaq Capital Market. If we are unable to achieve an increase in our stock price and our Common Stock is subsequently delisted, it could significantly and negatively affect our ability to obtain debt or equity financing in order to support Company operations.not independently provide stockholders with any such rights.

Required Vote of Stockholders

The approval of the Reverse Stock SplitShare Increase Proposal requires the affirmative vote of a majority of ourthe voting power of the outstanding shares of common stock entitled to vote on the Reverse Stock SplitShare Increase Proposal at the Special Meeting. Abstentions will be counted as votes against the proposal. Because we believe that this proposal is considered a routine matter, discretionary votes by brokers will be counted.counted and we do not expect any broker non-votes in connection with this Proposal.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” PROPSALPROPOSAL NO. 1.

PROPOSAL NO. 2- APPROVAL OF ADJOURNMENT PROPOSAL

We are asking you to vote to approve one or more adjournments of the Special Meeting to a later date or dates, if necessary, or appropriate to solicit additional proxies if there are insufficient votes to approve the Reverse Stock SplitShare Increase Proposal (Proposal No. 1) at the time of the Special Meeting or we do not have a quorum.

If our stockholders approve this Proposal No. 2, we could adjourn the Special Meeting and any reconvened session of the Special Meeting and use the additional time to solicit additional proxies, including proxies from stockholders that have previously returned properly executed proxies voting against the approval of the Reverse Stock SplitShare Increase Proposal. Among other things, approval of this Proposal No. 2 could mean that, even if we had received proxies representing a sufficient number of votes against the approval of the Reverse Stock SplitShare Increase Proposal such that the Reverse Stock SplitShare Increase Proposal would be defeated, we could adjourn the Special Meeting without a vote on the approval of the Reverse Stock SplitShare Increase Proposal and seek to convince the holders of those shares to change their votes to votes in favor of the Reverse Stock SplitShare Increase Proposal. Additionally, we may seek to adjourn the Special Meeting if a quorum is not present.

Our Board believes that it is in the best interest of the Company and our stockholders to be able to adjourn the Special Meeting to a later date or dates, if necessary, or appropriate to solicit additional proxies in respect of the approval of the Reverse Stock SplitShare Increase Proposal if there are insufficient votes to approve it at the time of the Special Meeting or in the absence of a quorum.

Required Vote of Stockholders

This proposal requires the affirmative vote of a majority of the votes properly cast for and against such matter. Abstentions will have no effect on the outcome of this proposal.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NO. 2.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 21, 2023March 18, 2024 by: (i) each director; (ii) each of the executive officers named in our annual report for the Summary Compensation Table;fiscal year ended December 31, 2023; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by us to be beneficial owners of more than five percent of its common stock.

| Beneficial Ownership | Beneficial Ownership | |||||||||||||||||||||||

| Beneficial Owner | Number of Shares | Percent of Total | Options exercisable and restricted stock units vesting within 60 days(1)(2) | Number of Shares | Percent of Total | Options exercisable and restricted stock units vesting within 60 days(1) | ||||||||||||||||||

| Greater than 5% stockholders other than executive officers and directors: | ||||||||||||||||||||||||

| Biofrontera AG Hemmelrather Weg 201 D-51377 Leverkusen, Germany | 8,000,000 | 30.0 | % | 400,000 | 7.9 | % | ||||||||||||||||||

| Abshagen Consulting GmbH Burgunderweg 8 Weinheim, Germany, 69469(4) | 3,148,042 | 11.8 | % | |||||||||||||||||||||

| Investor Company ITF Rosalind Master Fund LP(3) | 508,895 | 9.9 | % | |||||||||||||||||||||

| Lytton-Kambara Foundation(4) | 508,905 | 9.9 | % | |||||||||||||||||||||

| The Hewlett Fund LP(5) | 508,905 | 9.9 | % | |||||||||||||||||||||

| Entities affiliated with District 2 Capital Fund LP(6) | 509,062 | 9.9 | % | |||||||||||||||||||||

| Entities affiliated with AIGH Capital Management, LLC(7) | 509,209 | 9.9 | % | |||||||||||||||||||||

| Named Executive officers and directors: | ||||||||||||||||||||||||

| Hermann Lübbert | 113,379 | * | 195,812 | |||||||||||||||||||||

| Erica Monaco | 56,689 | * | 145,424 | |||||||||||||||||||||

| Hermann Luebbert | 10,440 | * | 6,891 | |||||||||||||||||||||

| Fred Leffler | — | 1,650 | ||||||||||||||||||||||

| John J. Borer | 22,000 | 1,100 | ||||||||||||||||||||||

| Loretta M. Wedge, CPA, CCGMA | 22,000 | |||||||||||||||||||||||

| Heikki Lanckriet | — | |||||||||||||||||||||||

| Beth J. Hoffman, Ph.D. | 22,000 | 1,100 | ||||||||||||||||||||||

| Kevin D. Weber | 22,000 | 1,100 | ||||||||||||||||||||||

| All current executive officers and directors as a group (7 persons) | 170,068 | * | 257,480 | |||||||||||||||||||||

| All current executive officers and directors as a group (6 persons) | 10,440 | * | 11,841 | |||||||||||||||||||||

| * | Represents beneficial ownership of less than one percent (1%) of the outstanding shares of Common Stock. |

| (1) | On December 9, 2021, the Company granted to Prof. Dr. Luebbert options (the “2021 Options”) to purchase shares of common stock at an exercise price of | |

| On |

| 11 |

| Information is based upon a Schedule 13G/A filed with the SEC on February 10, 2022 by Biofrontera AG. According to a Schedule 13D/A (“Zours Schedule 13D”) filed by Deutsche Balaton Aktiengesellschaft (“DB”), VV Beteiligungen Aktiengesellschaft (“VVB”), Delphi Unternehmensberatung Aktiengesellschaft (“DU”), Wilhelm Konrad Thomas Zours, Alexander Link and Rolf Birkert on September 19, 2022, Mr. Zours owns a majority interest in DU and is the sole member of the boards of management of VVB and DU. DU owns a majority interest in VVB. VVB owns a majority interest in DB and DB | ||

| (3) | Includes 504,261 shares of Common Stock and 4,634 shares of Common Stock issuable upon the conversion of the Preferred Stock. Each of Rosalind Advisors, Inc., Steven Salamon, and Gilad Aharon have shared voting and dispositive power with respect to these securities. The address for Rosalind Advisors, Inc., Mr. Salamon and Mr. Aharon is 15 Wellesley Street West, Suite 326, Toronto, Ontario, M4Y 0G7 Canada. The address of Investor Company ITF Rosalind Master Fund L.P. is c/o TD Waterhouse, 77 Bloor Street West, 3rd Floor, Toronto, ON M5S 1M2 Canada. | |

| (4) | ||

| (5) | Includes 504,168 shares of Common Stock and 4,737 shares of Common Stock issuable upon the conversion of the Preferred Stock. Martin Chopp has voting and investment control over the securities held by The Hewlett Fund LP. The address of The Hewlett Fund LP is 100 Merrick Road, Suite 400W, Rockville Centre, NY 11570. | |

| (6) | Includes (a) 251,377 shares of Common Stock held by Bigger Capital Fund LP (“Bigger Capital”) , (b) 251,377 shares of Common Stock held by District 2 Capital Fund, LP (“District 2 CF”) and (3) 6.308 shares of Common Stock issuable upon the conversion of the Preferred Stock held by Bigger Capital and/or District 2 CF. The address of Bigger Capital is 11700 W Charleston Blvd 170-659, Las Vegas, NV 89135. | |

| Bigger Capital Fund GP, LLC (“Bigger GP”) is a | ||

| (7) | Includes (i) 378,082 shares of common stock owned by AIGH Investment Partners, L.P. (“AIGH”), (ii) 95,164 shares of common stock owned by WVP Emerging Manager Onshore Fund, LLC – AIGH Series (“WVP-AIGH”), (iii) 28,188 shares of common stock owned by WVP Emerging Manager Onshore Fund, LLC – Optimized Equity Series (“WVP-OES”), and (iv) 7,775 shares of Common Stock issuable upon the conversion of the Preferred Stock held by AIGH, WVP-AIGH and/or WVP-OES. Orin Hirschman is the managing member of AIGH Capital Management, LLC, who is an advisor with respect to the |

DISCRETIONARY VOTING OF PROXIES ON OTHER MATTERS

The Company does not intend to bring before the Special Meeting any matters other than those specified in the Notice of the Special Meeting, and the Company does not know of any business which persons other than the Board intend to present at the Special Meeting. Should any business requiring a vote of the stockholders, which is not specified in the notice, properly come before the Special Meeting, the proxy holders specified in this proxy statement and in the accompanying proxy card intend to vote the shares represented by them in accordance with their best judgment.

STOCKHOLDER PROPOSALS AND NOMINATIONS FOR 20232024 ANNUAL MEETING OF STOCKHOLDERS

Any stockholder who meets the requirements of the proxy rules under the Exchange Act may submit proposals to the Board of Directors to be presented at the 20232024 annual meeting. Such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act and be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to our Secretary at our principal executive offices at the address set forth abovebelow no later than July 11, 2023, except as may otherwise be provided in Rule 14a-8 undera reasonable time before the Exchange Act,company begins to print and send proxy material for the 2024 annual meeting to be considered for inclusion in the proxy materials to be disseminated by the Board of Directors for the 2023such annual meeting.

The Bylaws also provide for separate notice procedures to recommend a person for nomination as a director or to propose business to be considered by stockholders at a meeting, other than proposals to be included in the proxy materials as described above.meeting. To be considered timely under these provisions, the stockholder’s notice must be received by our Secretary at our principal executive offices at the address set forth above no earlier than August 14, 202322, 2024 and no later than September 13, 2023; provided, however, that in the event that the date of the 2023 annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the first anniversary of the 2022 annual meeting, a stockholder’s notice must be received not later than the 90th day prior to the 2023 annual meeting, or if later, the 10th day following the day on which the public disclosure of the date of such annual meeting was made.21, 2024. Our Bylaws also specify requirements as to the form and content of a stockholder’s notice.

If a stockholder wishes to solicit proxies for a stockholder nominee for election to our board at the 2023 annual meeting of stockholders pursuant to Rule 14a-19 of the Exchange Act, notice must be submitted to our corporate secretary no later than October 13, 2023. Such solicitation and notice must comply with the requirements of Rule 14a-19 of the Exchange Act and our by-laws.

The chairperson of the meeting may refuse to acknowledge the introduction of any stockholder proposal if it is not made in compliance with the applicable notice provisions.

NOTICE REGARDING DELIVERY OF STOCKHOLDER DOCUMENTS (“HOUSEHOLDING” INFORMATION)

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports by delivering a single copy of these materials to an address shared by two or more Biofrontera stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies and intermediaries. A number of brokers and other intermediaries with account holders who are our stockholders may be householding our stockholder materials, including this Proxy Statement. In that event, a single proxy statement, as the case may be, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or other intermediary that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent, which is deemed to be given unless you inform the broker or other intermediary otherwise when you receive or received the original notice of householding. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker or other intermediary to discontinue householding and direct your written request to receive a separate proxy statement to us at: Biofrontera Inc., Attention: Corporate Secretary, 120 Presidential Way, Suite 330, Woburn, Massachusetts 01801 or by calling us at (781) 486-1510. Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request householding of their communications should contact their broker or other intermediary.

APPENDIX A

FORM OF REVERSEINCREASE IN AUTHORIZED COMMON STOCK SPLIT AMENDMENT

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

OF

BIOFRONTERA INC.

Biofrontera Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify:

FIRST. The Amended and Restated Certificate of Incorporation of the Corporation is hereby amended by changing the Article FOURTH, so that, as amended, the first paragraph of said Article FOURTH shall be amended and restated as follows:

The total number of shares of capital stock that the Corporation has the authority to issue shall be (i) [____________]35,000,000 shares of common stock, par value $0.001 per share (“Common Stock”) and (ii) 20,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock”).

SECOND. At [___] a.m./p.m. on [___________], 2023 (the “Split Effective Time”), every [_____][(__)] issued and outstanding shares of the Corporation’s common stock, par value $.0001 per share, as of the date and time immediately preceding the Split Effective Time (the “Old Shares”), shall automatically be reclassified as and converted into one (1) validly issued, fully paid and non-assessable share of common stock of the Corporation (the “New Shares”) without any further action by the Corporation or the holder thereof, subject to the treatment of fractional share interests as described below (the “Reverse Stock Split”). Further, every right, option and warrant to acquire Old Shares outstanding immediately prior to the Split Effective Time shall, as of the Split Effective Time and without any further action, automatically be reclassified into the right to acquire one (1) New Share for every [_____][(__)] Old Shares, but otherwise upon the terms of such right, option or warrant (except that the exercise or purchase price of such right, option or warrant shall be proportionately adjusted). No fractional shares shall be issued in connection with the Reverse Stock Split. Stockholders who otherwise would be entitled to receive fractional shares of common stock shall receive that number of New Shares based on the conversion ratio of their shares of Old Shares to New Shares set forth above, rounded up to the next whole share of common stock.

THIRD. That a resolution was duly adopted by unanimous written consent of the directors of the Corporation, pursuant to Section 242 of the DGCL, setting forth the above mentioned amendment to the Amended and Restated Certificate of Incorporation and declaring said amendment to be advisable.

FOURTHTHIRD. That this amendment was duly authorized by the holders of a majority of the voting stock of the Corporation entitled to vote at a duly authorized meeting of the stockholders of the Corporation held on [____], 2023.April 24, 2024. Said amendment was duly adopted in accordance with the provisions of the DGCL.

IN WITNESS WHEREOF, this Certificate of Amendment of the Amended and Restated Certificate of Incorporation has been signed by the Chief Executive Officer of the Corporation this [__] day of [__________], 2023.April, 2024.

| BIOFRONTERA INC. | ||

| By: | ||

| Chief Executive Officer | ||